Experian predicts 1 in 16 small businesses defaulting over the coming 18 months

Today, Experian releases findings from a sample of small- and medium-sized enterprises (SMEs) in the Netherlands, which reveals payment default risks will increase and credit scores will decrease over the coming 18 months. Through government financial support programs, businesses were provided financial relief from some economic impacts of multiple lockdowns and restrictions over the past year. However, Experian anticipates a change in this trend as government funding is expected to decrease as restrictions are planned to be released this calendar year. Decreasing credit scores will have an impact on the financial situation of these companies and therefore result in a higher chance of bankruptcy. The data from Experian shows trends for SMEs from September 2019 to December 2020, and the expected outlook over the next 18 months.

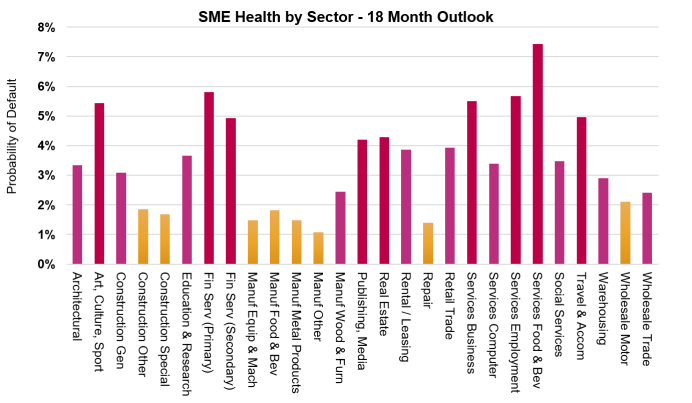

In 2021, businesses will be seeking alternate credit and lending schemes from financial institutions. A standard default rate – meaning no expected repayment on loans due to financial distress or bankruptcy – for SMEs in the Netherlands is typically 1.3% to 2.3%, but Experian expects the most at-risk industries to climb to 6% or higher, meaning 1 in 16 of these businesses will face insolvency and fail in the next year and a half. This is based on an analysis of traditional credit data (financial and payment data) and Web Data Insights (WDI) technology. WDI is an extensive analytics solution with which the credit risk of companies can be assessed based on non-traditional data. This allows for a more informed, more balanced and real-time understanding of the credit risks of small and medium sized companies.

The industries experiencing the greatest risk of default are food and beverage service industries (7%), travel and accommodation (5%), and employment services (5.5%).

“Our findings from the past year show a lot of what is commonly understood to be true about the industries facing the greatest challenges during the pandemic, such as food service, hospitality and travel”, says Herman Peeters, Principal Global Consultant for Experian Netherlands, “However, what the data demonstrates about future patterns of risk and recovery for SMEs is important. Historical data will no longer provide an accurate picture for lenders when deciding on credit applications for SMEs, and real-time, data-driven insights will be essential to get a better view of the risks and protect the future of these businesses.”

Most significant economic pressure points for SMEs during COVID-19:

- Least likely to survive extended business conditions

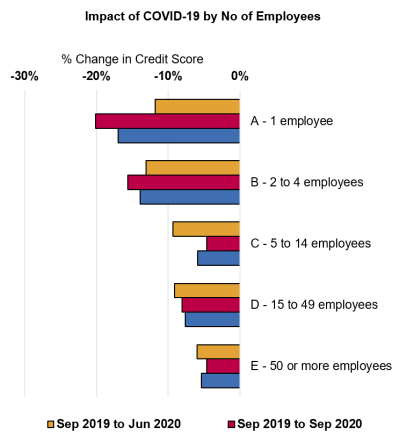

The initial impact of Covid-19 was more evident in smaller companies. Businesses with four or less employees show the biggest increase in credit risk over the period from September 2019 to December 2020, as shown in Figure 1.Very small companies (sole entrepreneurs and companies with up to 4 employees) remain under severe pressure and are two to three times more likely to fail over the next 18 months, compared to companies with 50 or more employees.

Figure 1: The initial impact of the coronavirus is more evident in smaller companies

- Government funding and support helps to stabilize, but effects are short-term

The credit risk outlook for companies with 5 or more employees stabilized in Q3 2020, most likely due to the easing of lockdown restrictions and the NOW financial support program launched by the Dutch Government – but these payments will run out and SMEs will seek financial funding elsewhere. - Extended pandemic measures also put pressure credit scores

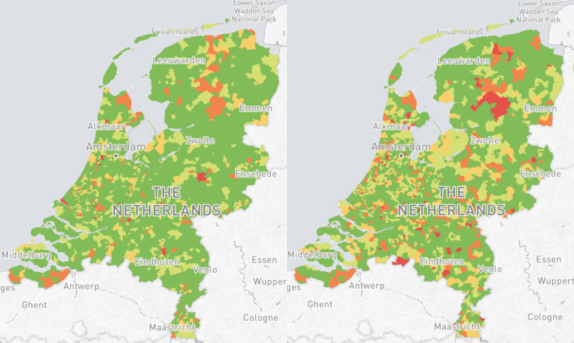

In 2020, there was a shift in credit scores amongst businesses across the Netherlands. Experian expects this outlook to deteriorate from a business solvency perspective over the coming quarters as benefits of payment holidays and support programs fade. In figure 2, heatmaps showcase the growing areas of credit risk across the country, with sections displaying the highest risk highlighted in orange and red. The changes from September 2019 to December 2020 are evident in various regions.

Figure 2: Heatmaps of the average credit risk score of a sample of SMEs at 30 September 2019 and 31 December 2020 by region.

Figure 2: Heatmaps of the average credit risk score of a sample of SMEs at 30 September 2019 and 31 December 2020 by region.

While the unemployment rate increased in the Netherlands in 2020, bankruptcies decreased – meaning that companies were likely letting go of staff to support cash flow and stay afloat. The pattern is not sustainable for the long-term, as many of these companies will be at increased risk once government financial support subsides.

“We are yet to see the full picture of long-term economic impacts of COVID-19 for SMEs in the Netherlands, but what the data shows us is that many industries will be at risk of low credit scores, decrease in business solvency, and high rates of bankruptcy over the coming months,” adds Peeters, “Without government financial support and restrictions looming, the smallest SMEs will be unable to recover financially. Segmented portfolio insights and differentiated approaches in originations, collections and recoveries are key. A ‘’one size fits all” approach is not applicable anymore.”

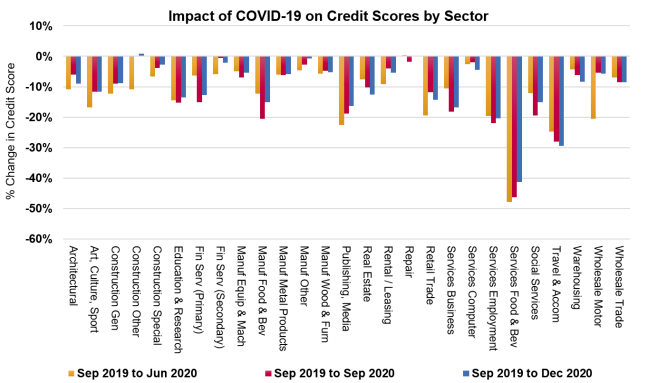

Figure 3: These sector scores are based on traditional credit metrics (financial and payment data) and Experian’s web data insights.

The data in Figure 3 (above) shows the change in credit risk scores of a sample of SMEs from September 2019 to December 2020 by sector. A significant increase in risk is observed from June onwards. This increase is attributable to the impact of COVID-19 – both directly and indirectly – on SME business conditions in the Netherlands. A recovery in certain sectors is evident post June 2020; however, the expectation is that these credit scores will gradually decline in a delayed effect as government and financial funding depletes for these businesses.

The data in Figure 4 (below) demonstrates expected default rate over the next 18 months on the analyzed SME sample by sector as of December 31, 2020. The higher default risk is driven by the impact of COVID-19 on business conditions and the size of a company, as smaller companies are expected to have less of a buffer to protect against unexpected external shocks like COVID-19.

Figure 4: Construction, manufacturing, repair and wholesale sectors reflect risk levels that are within the normal range; however, food and beverage, travel, and employment/business services remain at high risk.

If lockdown restrictions continue in the Netherlands, the financial reserves of more companies will be exhausted in the coming months, resulting in more payment defaults and insolvencies.